Latest Trends and Observations

-

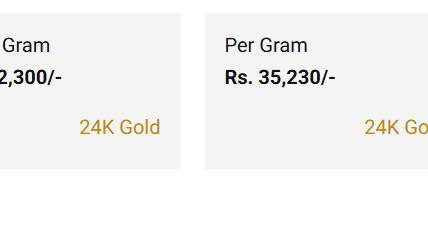

The charts on GoldPrice.org indicate that gold prices have shown sharp fluctuations in recent months — with both sudden spikes and periods of stabilization.

-

Historical data highlights that whenever global financial pressure increases, investors tend to turn toward gold as a reliable asset.

-

The gold-to-silver ratio, also featured on the site, offers insight into how expensive gold is relative to silver, signaling when investors might shift between the two metals.

What Could Influence Future Prices?

-

Inflation and Central Bank Policies

Lower interest rates or persistent inflation typically increase demand for gold. -

Currency Stability and Global Pressures

A weakening U.S. dollar or international financial stress can drive gold prices higher. -

Investor Sentiment and Market Trends

If large investors and hedge funds increase their gold holdings, the price could rise significantly.

Conclusion

GoldPrice.org is a valuable resource not only for checking the latest gold prices but also for analyzing past market behavior. Current trends suggest that gold remains a strong hedge against uncertainty. If inflation persists, global currencies weaken, or market instability continues, gold prices may keep climbing — reaffirming its role as a cornerstone of safe investing.